PERFORMANCE HIGHLIGHTS

|

KEY FINANCIAL DATA |

2020 |

2019 |

Change YoY |

|

|

|

|

|

|

Operating Revenue (RMB billions) |

303.84 |

290.51 |

4.6% |

|

Of which: Service Revenue (RMB billions) |

275.81 |

264.39 |

4.3% |

|

EBITDA1 (RMB billions) |

94.14 |

94.36 |

–0.2% |

|

As % of Service Revenue |

34.1% |

35.7% |

–1.6pp |

|

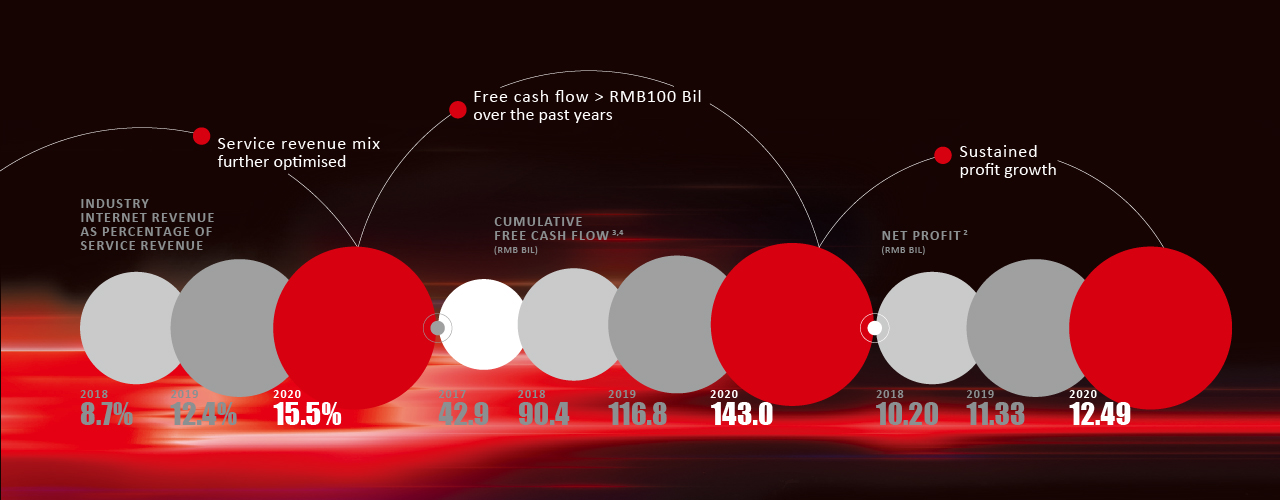

Net Profit2 (RMB billions) |

12.49 |

11.33 |

10.3% |

|

Basic EPS (RMB) |

0.408 |

0.370 |

10.3% |

|

Free Cash Flow3 (RMB billions) |

26.2 |

26.4 |

–0.8% |

|

|

|

|

|

| Note 1: | EBITDA represents profit for the year before finance costs, interest income, share of net profit of associates, share of net profit of joint ventures, other income-net, income tax expenses, depreciation and amortisation. As the telecommunications business is a capital intensive industry, capital expenditure and finance costs may have a significant impact on the net profit of the companies with similar operating results. Therefore, the Company believes that EBITDA may be helpful in analysing the operating results of a telecommunications service operator like the Company. However, it is a non-GAAP financial measure which does not have a standardised meaning and therefore may not be comparable to similar measures presented by other companies. |

| Note 2: | Net profit represented profit attributable to equity shareholders of the Company. |

| Note 3: | Excluded the impact of adoption of IFRS/HKFRS 16 on free cash flow in 2019 and 2020 (i.e. free cash flow = operating cash flow — CAPEX — capital element of lease rentals paid.) |

| Note 4: | Calculated the cumulative free cash flow generated since 2017. |